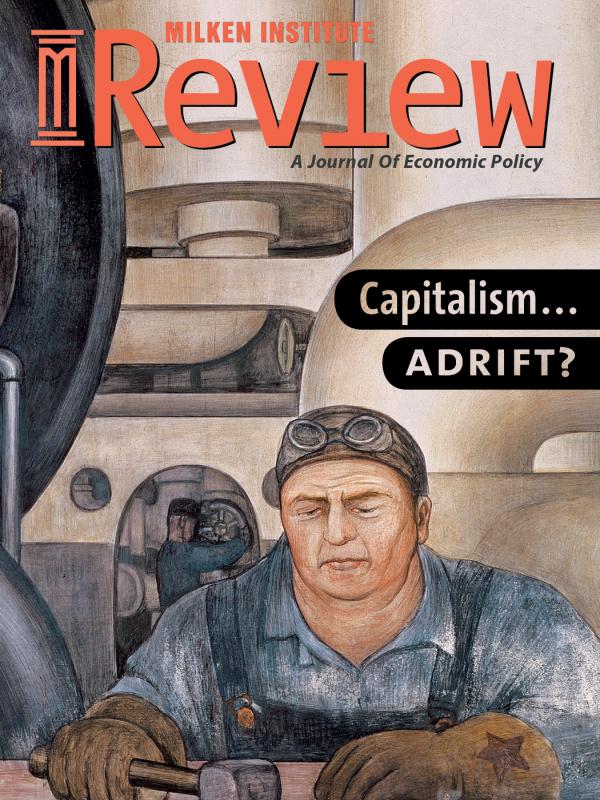

Fourth Quarter 2015

The States Try Supply-Side Tax Cuts

Bad Idea Redux. by William G. Gale, Aaron Krupkin and Kim Rueben.

The Browning of America

Coming together.

Bitcoin

An idea that will change the world. By Staci Warden

The Scary Debate Over Secular Stagnation

Hiccup ... or Endgame? By J. Bradford Delong

China’s Money Goes Global

This is gonna be tough. by Barry Eichengreen

Who Gets What – and Why

Book Excerpt Alvin Roth explains how matching markets fail, and how to fix them.

Letter from Italy

Sweet survival. by Charles Castaldi

The Urgent Need to Measure Patient Safety

Scorecard needed. by Thomas R. Krause

Institute News

Rating China's cities.

Afterthought

Marxism redux.

Summary of this Issue

In this issue, brad delong, of the University of California, Berkeley, offers an analysis of Former Treasury Secretary Larry Summers' controversial claim that the United States and Europe face a bleak economic future unless government provides an ongoing boost. staci warden, of the Milken Institute, concurs with the mainstream view that "Bitcoin's core value proposition as a substitute for regular currencies is, frankly, questionable."

barry eichengreen, another economist at Berkeley, steps back from the speculation about the prospects for the Chinese renminbi as a global currency to ask why it matters. charles castaldi, a former NPR journalist, takes a trip back to his native Italy to assay the country's prospects in the midst of Europe's financial agonies.

william gale, aaron krupkin and kim rueben of the Brookings-Urban Institute Tax Policy Center in Washington examine state governments' obsession with supply-side tax policy.

alvin roth, a Nobel economist who is the author of the new book, Who Gets What – and Why, explores "matching markets," in which price alone can't balance supply and demand – think of markets for everything from marriage to college admissions to donated kidneys.

thomas krause, a consultant on workplace safety, argues that the first step in reducing unnecessary hospital deaths is to measure the horrific toll accurately.